When you own a property, fully functioning utilities like drains are essential. Unexpected drain issues can be stressful, disruptive and costly, and if you’re planning to sell in the near future, you may even need a pre-purchase drain report.

If you have any drain problems, this is where drain insurance comes in handy, offering a safety net against financial burdens arising from this type of issue. However, understanding what drain insurance covers is the key to making informed decisions.

Want to know more about what’s covered under your drain insurance? Read on.

What does my drain insurance cover?

Drain insurance usually covers the costs of repairs or replacements if there’s damage to your property’s drainage system. This includes blockages, leaks and structural issues. Additionally, many policies extend coverage to external drains, such as those on your home’s boundary or underneath your driveway. Some plans may also include coverage for clearing blocked sewers.

However, with any type of home insurance, you must review your policy carefully to understand the specific coverage inclusions, exclusions and conditions. While basic coverage may address the most common drain problems, extended policies can provide greater protection against a wider range of circumstances.

Is tree root drain damage covered by insurance?

A common problem we come across is tree root damage to drains. Roots cause untold issues by infiltrating pipes, causing blockages and damaging drain structures. Whether the damage is covered by your insurance depends on your policy’s terms and conditions. Some insurers may include tree root damage as part of their standard coverage, while others may consider it an exclusion.

If you’re concerned about potential tree root damage to your drains, consult your insurance provider to discuss your options and see what’s covered. You should also take proactive measures like regular drain maintenance and root barrier installations, if possible, to mitigate the risks.

Who pays for a collapsed drain?

Collapsed drains are considered one of the most complex drain issues you can experience, often caused by poorly maintained drains, pipe damage or sewer damage. The responsibility for repairing a collapsed drain usually falls on the homeowner unless it’s largely within a public sewer.

However, if you have drain insurance, the costs may be covered under your policy, subject to its terms and conditions. Report any suspected drain collapses to your insurance provider as soon as possible and follow their guidance to submit a claim.

Can you liaise with my drain insurance provider?

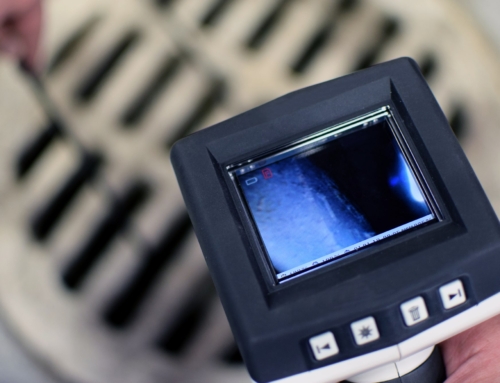

Navigating the intricacies of insurance policies can be daunting for homeowners. Luckily, reputable drainage companies like The Drain Survey Company can liaise with your insurance provider, assessing the extent of the drain damage, providing expert advice and producing CCTV evidence of the issue affecting your system.

Getting a drain surveyor on board early can also help restore your drainage system to optimal condition as quickly as possible.

Get expert support with your drain insurance claim

If you have a drainage issue, get in touch with The Drain Survey Company. We offer CCTV drain surveys in London and Essex, covering Highbury, Islington and beyond. For a free quote, call now on 020 4538 4399.